Global growth is slowing as US tariff policy reduces trade and heightens geopolitical uncertainty, which ultimately will lead to decelerating growth in insurance premiums, according to Swiss Re.

Global GDP growth (adjusted for inflation) is expected to slow to 2.3% in 2025 and 2.4% in 2026, down from 2.8% in 2024, Swiss Re Institute in its report titled “World insurance in 2025: a riskier, more fragmented world order.”

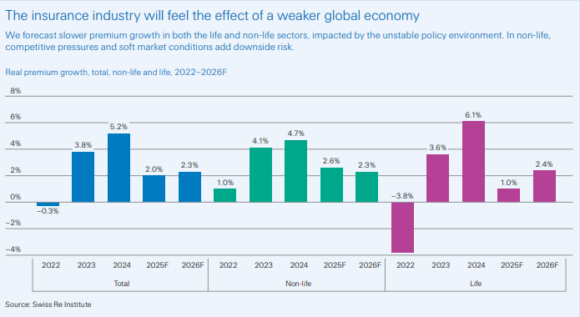

The global insurance industry (life and non-life) is expected to follow the trend with total premiums slowing to 2% this year from 5.2% in 2024, and picking up marginally to 2.3% in 2026, Swiss Re said.

“U.S. tariffs create new risks for insurers, with negative impacts expected through inflation, trade, supply chain and economic growth outcomes,” the report said.

Property/Casualty Sector

“The primary non-life insurance sector is seeing decelerating premium growth as insurance pricing softens and policy uncertainty cuts economic momentum,” said Swiss Re, forecasting 2.6% growth in real terms in 2025 (versus 4.7% in 2024) and 2.3% in 2026.

Real premium growth in advanced markets reached 4.5% in 2024, higher than the 3.8% reported in 2023 as well as the previous 10-year average of 3.5%, the report said, noting that the decade-high growth in 2024 was driven by rate hardening, with insurers increasing prices to cover rising claims severity.

Global life premium growth will also slow down – forecast by Swiss Re to drop to 1% this year in real terms, after a strong 6.1% gain in 2024.