A recent surge in high-profile cyberattacks is offering an opportunity for insurers including Munich Re AG and Chubb Ltd. to cash in from a rapidly expanding market — and prompting a rethink on premiums.

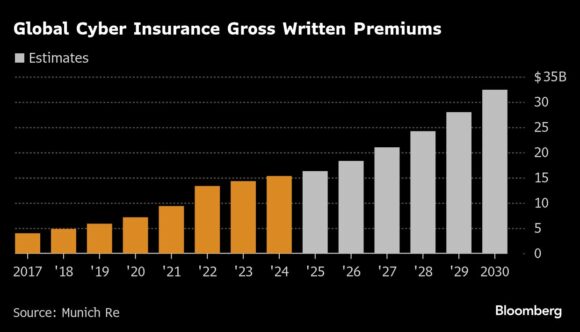

As artificial intelligence makes attacks more widespread and devastating, Munich Re expects the global cyber insurance market to reach $16.3 billion in 2025, up from $15.3 billion in 2024. Global premium volume is expected to more than double to around $30 billion by 2030, growing at an average annual rate of more than 10%.

With the vast majority of risks still uninsured, an estimated $9.5 trillion was lost globally in hacking crimes in 2024, according to technology consultant Cyber Security Ventures, a staggering increase from the $600 billion McAfee estimated in 2018.

The latest victim, Marks & Spencer Group Plc, is still grappling with the fallout. The hack, first reported on April 22, disrupted sales and operations at the British retailer and sent its shares plunging. It faces a £300 million ($405 million) hit to operating profit this year, before mitigation through cost savings and insurance.

Beazley Plc, a pioneer in cyber insurance, saw a short-term increase in demand for coverage following the M&S hack.

“When high-profile breaches happen, shareholders start asking questions,” Sydonie Williams, the company’s head of international cyber risks, said in an interview. “There was a sense of ‘that could have been us.'”