Direct written premiums in the U.S. homeowners insurance market rose more than 13 percent in 2024, and the net combined ratio for the line fell below breakeven for the first time in five years.

Higher prices explained much of the industrywide loss and combined ratio improvements, but not all homeowners insurers grew premiums last year, a new report from S&P Global Market Intelligence reveals.

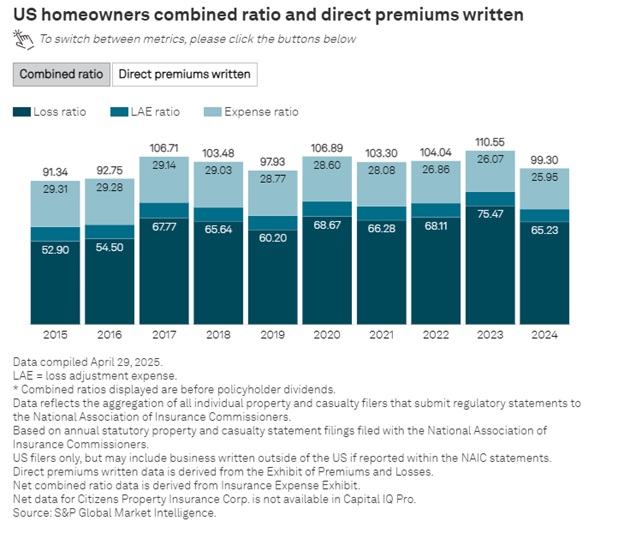

The new report, “Premiums rise, ratios recede for U.S. homeowners insurers in 2024,” shows that in spite of five tropical cyclones and numerous severe weather events, the industrywide net combined ratio for homeowners (excluding policyholder dividends) was 99.3 in 2024, 11.2 points better than the 110.5 ratio recorded in 2023.

The 99.3 marked the first time since 2019 that the ratio was below 100, the report said.

(Editor’s Note: Earlier this month, Carrier Management reported on a separate report from S&P GMI in an article titled “2024 P/C Insurance Combined Ratio: Best in More Than a Decade,” which showed the homeowners net combined ratio landing at 99.7 last year. The 2024 combined ratio in the prior report included policyholder dividends. The latest report on just the homeowners line does not.)

The report shows industrywide homeowners net combined ratios (including loss ratio and expense components) for the last decade on an interactive chart, which also provides tallies of direct written premiums and year-over-year premium jumps for each year from 2015-2024. Overall, direct premiums written in the sector rose 13.4 percent to nearly $173.1 billion. The increase marked the second-highest since 2015, behind a 14.1 percent leap recorded in 2023.

The national average rise in owner-occupied homeowner rates in 2024 rose to 11 percent from 9.7 percent in 2023, according to Market Intelligence’s RateWatch application, the report said.