Global insured losses from natural catastrophes hit US$137 billion in 2024, following the 5%-7% annual growth rate that has been the norm in recent years, according to Swiss Re analysis.

If this trend continues, global insured losses will approach US$145 billion in 2025, mainly driven by secondary perils such as severe convective storms (SCS), floods and wildfires, said the Swiss Re sigma report titled “Natural catastrophes: insured losses on trend to USD 145 billion in 2025.”

While loss severity for nat cats is rising globally, North America accounted for almost 80% of global insured losses in 2024, due to the region’s exposure to severe thunderstorms, hurricanes, floods, wildfires, and earthquakes, the report said. (Editor’s note: the 80% figure can be found on page 29 of the main report, table 3).

“As has been the case in recent years, in 2024 most of the global insured losses were driven by secondary perils, in particular severe convective storms in the US,” Swiss Re said, noting, that the deadly fires in Los Angeles in January this year point to another year of high losses from secondary perils.

Global economic losses from catastrophes were US$318 billion, the highest since 2017 (US$448 billion in 2024 prices). “Around 43% were covered by insurance, highlighting the continued existence of large protection gaps in many parts of the world, including in advanced economies,” the report said. The 2024 insurance protection gap of $181 billion — up from $177 billion in 2023 — is the difference between overall economic losses and the amount covered by insurers.

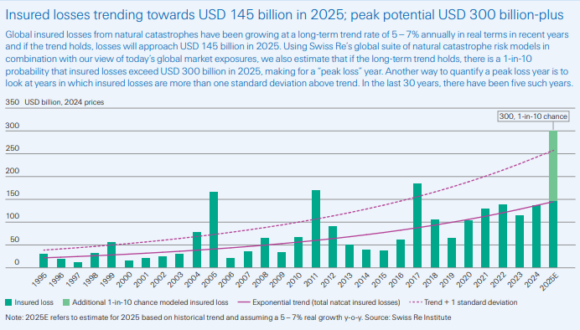

Peak-Loss Years

Despite the high price tag from secondary perils, Swiss Re warned, it is primary perils (tropical cyclones and earthquakes) that remain the biggest contributor to insured losses overall. Swiss Re pointed to the five so-called “peak loss” years that have occurred in the last 30 years (1999, 2004, 2005, 2011 and 2017), when annual losses were way above trend.

In 2017 – the last peak-loss year – Hurricanes Harvey, Irma and Maria drove global insurance losses to 111% above trend, but Swiss Re warned that the subsequent period of quiet since then did not slow the underlying growth of risk.

Swiss Re’s natural catastrophe models point to a 1-in-10 probability that global insured losses could reach as high as US$300 billion in 2025, creating next peak-loss year. (See above graphic).

Swiss Re cautioned that peak loss years, “due to either the accumulation of many loss events or those from a few individual large events, should not be considered a freak occurrence.” “History repeats, and it’s not a question of if, but when the insurance industry will face the next peak loss year.”