The 2025 Solar Risk Assessment report, recently released by kWh Analytics, has sparked significant discussion among industry professionals about the evolving challenges facing renewable energy assets. To explore the report’s findings in depth, kWh Analytics convened its Renewable Energy Broker Council, bringing together leading insurance brokers specializing in solar and battery storage to share their perspectives on the industry’s most pressing risks. The council provided a platform for these experts to discuss the implications of the report’s findings and identify strategies for stakeholders.

The Broker Council consisted of the following participants: Rob Battenfield (AmWins), Todd Burack (McGriff), Mike Cosgrave (Renewable Guard), Brian Fitzgerald (WTW), John Katilus (Aon), Geraldine Kerrigan (CAC Specialty), Alex Post (Alliant), and Luke Slemeck (Marsh).

Advancing Hail Risk Mitigation

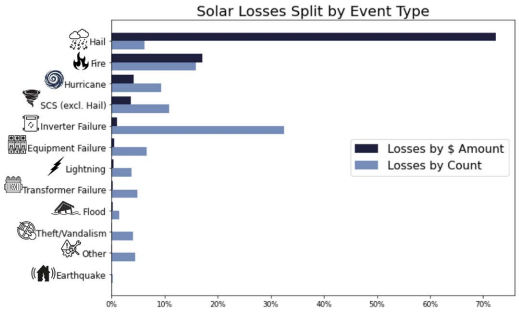

The 2025 Solar Risk Assessment highlighted hail as the dominant cause of solar losses, accounting for 73% of total losses by damage amount despite representing only 6% of loss incidents. This finding resonated strongly with the brokers, who emphasized the critical importance of robust hail defense strategies and the evolution toward more data-driven approaches.

Mike Cosgrave from Renewable Guard emphasized how clients are embracing more sophisticated risk engineering: “What’s really resonating with our clients is asking resources, like VDE Americas, to rerun models to see the effects of resilience measures like thicker modules and different stow angles on Probable Maximum Losses (PMLs, an important metric in insurance). In some cases, our clients are collaborating with us very early in the process. Design and equipment decisions are being made on this basis very early in the development process. For the Sponsors, it’s both a question of cost benefit, along with an overall desire to reduce risk. That’s where I’m seeing a lot more collaboration between insureds and others in the industry.”