Strong returns in the reinsurance sector are attracting capital and leading to favorable pricing outcomes for buyers — but underwriting discipline continues, according to renewal reports from three reinsurance brokers.

Despite heavy natural catastrophe losses in the first quarter, reinsurance capacity has exceeded demand.

“[T]raditional reinsurers targeted growth and deployed more capacity at the mid-year renewals, which is accelerating the trend toward buyer-friendly conditions and leading to greater flexibility in terms and conditions as well as options to purchase expanded coverage,” said Aon in its report titled “Reinsurance Market Dynamics – Midyear 2025 Renewal.”

Read more: California Wildfires Had Little Impact on Reinsurers’ Risk Appetite During April Renewals

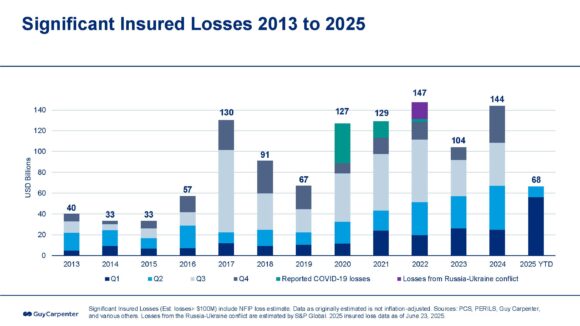

Reinsurers’ balance sheets continue to be strong, which is driving an appetite for growth — despite insured losses through the first half that are nearing $70 billion, said Guy Carpenter in its report titled “Strong returns in reinsurance sector attracts capital, leading to favorable client outcomes.”

For the first quarter alone, global insured losses from natural catastrophes were estimated at around $60 billion – the second highest Q1 loss on record – which was driven by the $40 billion California wildfire loss, Aon said. “The first half of 2025 is likely to become the second costliest on record due to additional catastrophe activity in the second quarter, including two large severe weather outbreaks in the U.S. on May 14-17 and May 18-20.”

Nevertheless, the mid-year renewals saw overall pricing continue to moderate. Aon noted there were “significant variation in renewal outcomes” as reinsurers differentiated cedents by loss experience and performance.

“Clients were largely able to secure risk-adjusted rate reductions for property treaties and were well-placed to hold pricing broadly flat in casualty lines – in part, as underlying pricing increases continue to flow through to reinsurers,” agreed Gallagher Re in its report titled 1st View: Challenging the Status Quo.

“After several highly profitable years, reinsurers are increasingly looking to deploy their significant capital, but they are disciplined in approach. In some businesses and geographies, we are still seeing reinsurers willing to sacrifice share to protect profitability — particularly larger, less growth-oriented players,” said Gallagher Re.