Property-catastrophe capacity remained adequate to meet demand during the April 1 renewals for US reinsurance buyers, despite the record losses from California’s January wildfires, according to Aon and Gallagher Re in their renewal reports.

Reinsurers continued to demonstrate an appetite for growth for US property-cat exposures during the April renewals, while alternative capital markets provided healthy competition and new start-up reinsurers looked for growth opportunities, Aon said in its report, titled Reinsurance Market Dynamics – April 2025 Renewal.”

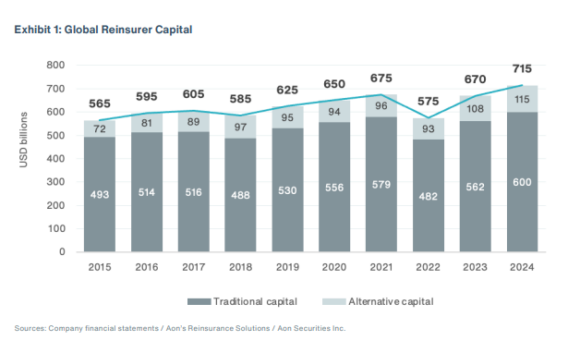

The California wildfire losses have not led to a market-wide change in reinsurer appetite or pricing, said Aon, noting that reinsurance capital continues to grow and keep pace with increasing demand. (Related article: Buyer-Friendly April Reinsurance Renewal Bodes Well for Mid-Year Renewals: Brokers).

Aon acknowledged that the Los Angeles wildfires (expected to cost the re/insurance industry between $32 billion and $38 billion) had mixed results for the relatively small and diverse group of U.S. regional and national insurers that renewed at 4/1 – based on their exposures and loss experience. (The wildfires also had little to no impact on reinsurance capacity, pricing and terms for buyers in Asia Pacific, the region that dominates the 4/1 renewals, Aon said).

“Reinsurers continued to trade and deploy capacity uninterrupted, with continuing support for insurers with significant wildfire exposure. Some reinsurers stepped up to offer additional wildfire capacity and were rewarded with larger signings,” Aon said, adding that the majority of reinsurers responded “outstandingly” to the LA wildfires, which will like rank among the top three costliest wildfires in U.S. history.

“Property-catastrophe capacity remained ample despite the wildfires, with buyers taking advantage of this increase in supply to hold retention levels constant, and push price reductions at the top end of programs,” according to Gallagher Re in its report, titled “1st View – Finding the Path.”

“Impacted renewals were limited in number, and specific outcomes were dependent on buyer loss experience and program size,” Gallagher said.

“The Los Angeles wildfires tempered reductions and led to more conservative quoting at 4/1, although the impact was largely localized. Loss-free accounts achieved risk-adjusted rate reductions in line with January 1, while loss-impacted accounts typically experienced stable conditions,” Aon said.

“Terms and conditions around wildfire were a key topic of discussion with reinsurers as each insurer determined with their trading partners the most effective path forward for their portfolio exposure,” Aon continued.